“A new era of transparency and improved data use, will produce a more sustainable, fairer and safer industry, thus benefitting all.”

The challenge isn’t what we need, it’s how it’s developed and implemented, in order to allow those who bet within their means to bet without undue intrusion, whilst importantly, protecting those with a gambling disorder, and gambling companies from a combination of fraud and cheating punters.

The weekend just gone used to be one of my favourite NH racing weekends of the year.

Around 6-7 years ago I discovered iovation or more accurately a computer ‘nerd’ friend did. He explained to me how it worked & after further investigations J4P told the Gambling Commission (GC). For the uninitiated, iovation is an online tracking service that is downloaded to your e-device without your knowledge when visiting gambling operators’ websites. I filed a personal complaint to the Information Commissioner’s Office (ICO) about the sharing of my data, which was completed without my knowledge. The ICO found for me against a gambling company. This decision has disappeared off the ICO website, but don’t worry I have the correspondence.

Despite the data practices I complained about breaching privacy law, no financial penalty was handed-down: The gambling company was instructed to improve their privacy policy, nothing more. They did. This experience taught me & other J4P volunteers how gambling companies were able to tell each other pseudo-anonymously about customers they didn’t want.

I asked my friend to do some more investigations. He came back saying, you need someone with far better knowledge than me, but I can tell you, what is happening is wrong, just wrong. J4P did not have the expertise nor the money to pay for said expertise. We hoped others might do, certainly the ICO and the GC could have found the money, but chose not to.

Fast forward to last week

Since my ICO decision, J4P had presented evidence of data malpractice of many forms to the regulators more than once, e.g. illegal privacy policies, poor provision of data using inaccessible formats, missing data in subject access requests, refusals to provide data that people were legally entitled to, a refusal to delete data, etc. The regulators did little, certainly nothing of note, worse still they knowingly allowed illegality to continue. The ‘Cracked Labs’ report (links follow) does not touch on specific iovation codes for the gambling industry, which are shared between gambling company subscribers, thus the situation is even worse than ‘Cracked Labs’ has found.

Technical report (if you really want to understand what goes on)

https://cdn.sanity.io/files/btrsclf0/production/6217f28e8b2360268c0a4d32dc2910897e1d639f.pdf

Narrative report (if you want to know, but in more informal language)

https://cdn.sanity.io/files/btrsclf0/production/da2d02ccf382c5c58931433234ab6174ae7b5824.pdf

Executive summary (if you’re not really bothered, but do like to shout)

https://cdn.sanity.io/files/btrsclf0/production/e23ea75fe93f775d9f9ed795427f4b5ed8d67016.pdf

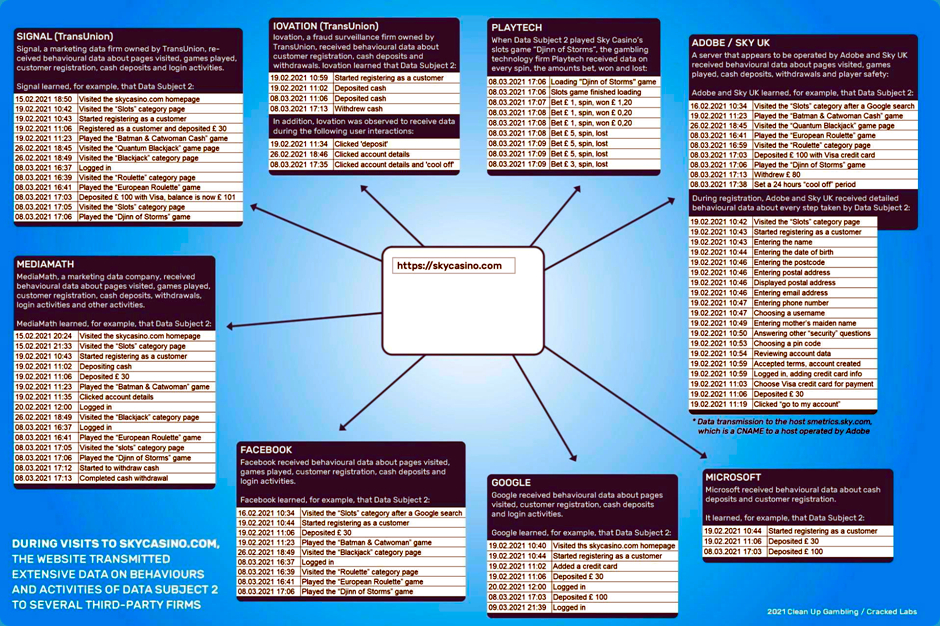

Figure 1: Examples of data flow

Hopefully, Figure 1 mainly explains itself? Punters (bettors if you wish) may not think there is much to see here, because many use Facebook, Google and Microsoft frequently, but that’s not the point. Did punters ever think that when they deposited to a gambling website that these three companies would know they had and also know how much they deposited, and that Signal would know what their gambling company balance was?

The most important thing here is, that it is possible some of these companies through this data sharing are likely to be able to personally identify each individual punter. This means the end of pseudo-anonymisation in the data sharing process. This therefore has become a major privacy law issue.

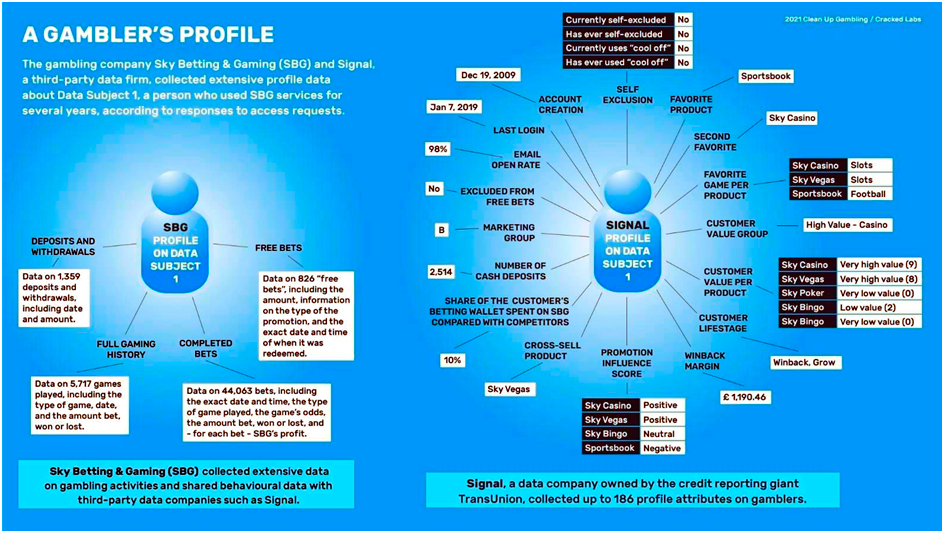

Figure 2: A Gambler’s Profile

Figure 2 is another one where some may go, so what, don’t companies in other industries do this? This is certainly true, but because of the nature of gambling this data sharing has become more detailed and thus possibly more intrusive for good or bad reasons.

As an example, “Excluded from free bets” = NO. So what, again, some may say? Take a quick look at figure 3 and you may change your view? Betway, Boylesports, Unibet seem likely to be able to see this information through the third party Signal (not SkyBet), so are you still OK? Let’s say the answer to “Excluded from free bets” was YES, would you be happy then? Even without adding the iovation database codes into the discussion, it is becoming clear why people sometimes get banned from free bets, stake restricted or have their sports betting side of an account closed before placing a bet or after only placing a few bets.

This is without doubt non-transparent trading, so unfair trading, thus a breach of one of the main objectives of the 2005 Gambling Act (trading should be fair and open) and a breach of privacy law.

Now the potential good bit. Near the top of figure 2 you will see some questions related to self-exclusion and time-outs. Well it would be good, especially when combined with the iovation shared database code 99-3 for self-exclusion, if customers who are self-excluded with one gambling company that uses Signal and/or iovation weren’t allowed to gamble with other gambling companies using Signal and/or iovation. J4P has seen little evidence that customers self-excluded or timed-out with one gambling company are treated as such by rival gambling operators.

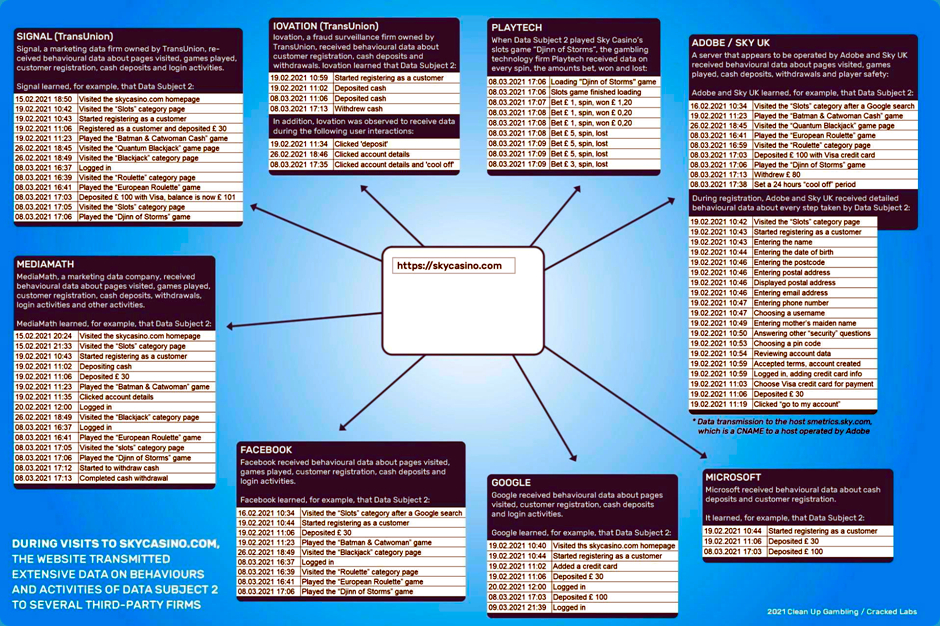

Figure 3: Where is data shared?

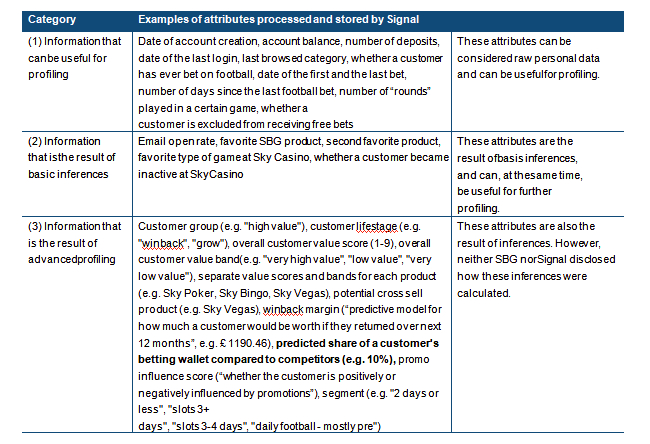

The main message to take away from figure 3 is that despite denying the fact for years gambling companies, which use certain third party services and certain cookies/trackers, can see certain data when an individual is gambling with other gambling companies. The following quote is taken from deeper in the ‘Cracked Labs’ report, “… predicted share of a customer’s betting wallet compared to competitors, e.g. (10%).” Wow, just wow! Yet again J4P told the GC, ICO and the government (DCMS) this years ago. Herewith figure 4 containing this quote.

Figure 4

30 million ‘flutterers’

The Betting and Gaming Council estimates there are 30 million ‘flutterers’ in the UK. They and others are, nearly daily, pleading with government not to impinge on the civil liberties of the 30 million ‘flutterers’. What they’re forgetting to mention is that some of their members are already impinging on the civil liberties of the 30 million ‘flutterers’ and illegally. After all the Betting and Gaming Council are paid by the industry, so why would they tell the “30 million” the whole truth.

‘Cracked Labs’ observed that some of this data abuse even occurs when a person doesn’t log-in to a gambling website, e.g. a person just visits a website as a non-customer, but similar data flow processes begin. This means that ASOS may think you have a gambler using an e-device in your house, even though you haven’t, so what? Not a big what really, unless you try to apply for Google Pay or other payment methods ASOS accept, especially their ‘buy now, pay later’ options.

Nevertheless, if you wish, continue to make your deposits online ‘flutterers’, despite the fact that those very personal transactions may be communicated instantly to Facebook and Google, and where Signal may then analyse your gambling and feedback on how best to get you more engaged & hopefully lose more. And never forget you may end up not anonymised & you will certainly get banned across gambling companies if you dare to show signs of winning or ‘God-forbid’ win using skill (note that gambling industry marketing never mentions this), ps: there are nowhere near 30 million regular ‘flutterers’ who gamble using online casinos or online sportsbooks/betting exchanges, e.g. those that may be affected by the on-going UK Gambling Act review. The 30 million figure concerns all types of gambling, but the Betting and Gaming Council’s attention to detail is conveniently lacking.

Signal & iovation can help gambling companies to protect those with a gambling disorder, but don’t ‘bet’ on gambling companies doing that. As already mentioned, J4P knows gambling companies, sometimes (often?) may not use this part of these services, and when in communication with vulnerable people lie about what is actually possible.

Who else knew and kept silent

Not all, but nearly every punter’s ‘friend’. This includes a great deal of the specialist media, most organisations who sell their services to punters (disgusting), and 98% of gambling affiliates (to be expected).

Incompetence

Recently the worst ‘turd’ of all was when the GC put the Betting and Gaming Council i/c developing the so called ‘single customer view’. The incompetence of this decision is unforgiveable, when you think about what the GC and ICO already knew about the legal, regulated UK gambling industry’s data practices. Within the last 48 hours its been announced by the Betting and Gaming Council that GamStop, another gambling industry funded organisation, has been chosen to develop the project (nothing like a bit of independence – argh!!). The non-evidenced rhetoric around these decisions, if it’s possible, has been even worse. It’s always easier to blame someone else or to blame someone or some organisation you don’t like, than do your homework and come up with the truth.

The chances of me Brian Chappell (Jimmy Justice) providing my bank account details to a gambling company is zero. After all, I refused to provide a selfie stood next to my passport to a tin-pot online bookie seven years ago in order to receive £40. Even after ADR, I didn’t get the £40: Big mistake! Neither the ADR nor the bookie has a licence to operate in the UK anymore. More importantly, does the UK need improved use of customer data, improved sharing of data in very, very specific circumstances, and more robust fines for independently assessed individual cases where gambling harm has occurred, not just systematic failings? Too right the UK does.

“Improved” is the key word here, because as ‘Cracked Labs’ has proven and to a lesser extent before this J4P, customer data collection and analysis is already extremely widespread online. The data and analyses are then sometimes (often?) shared between some gambling companies (often illegally).

The present system of fines has failed to deter repeated breaches of gambling regulation by some gambling companies. The fines for some have simply become an item on the expenditure side of their accounts, a bit like paying for staff or marketing, change is needed. The profit incentive that facilitates some of the present gambling harm must be taken out of the equation.

The challenge

The challenge isn’t what we need, it’s how it’s developed and implemented, in order to allow those who bet within their means to bet without undue intrusion, whilst importantly, protecting those with a gambling disorder, and gambling companies from a combination of fraud and cheating punters.

In my opinion, from what I’ve read (a lot) the UK is nowhere near addressing what needs to be developed, let alone implemented, so we will end with up with another mess that facilitates the unfairness and harm that currently occurs in the UK’s legal and regulated market. This is inexcusable and presents many of those with the power to bring about change in a very poor light.

Forget a ‘cure’

The gambling industry and regulation will never ‘cure’ gambling disorder, it is a psychiatric condition, but there are a number of pretty simple things that can be done to vaccinate (very topical) against the worst harms and to reduce the spread (incidence and prevalence, assuming the UK ever measures it correctly). The same goes for fairness (both gambling companies and punters [bettors if you wish] have a role in this). There is no question that data management is the key to both increasing fairness and reducing harm, alongside harsher penalties. J4P and I have said this again and again. You can mess around the edges spending millions on this and that, but we live in a data rich world, data should be used for good in gambling, but so far many are guilty of using it for the converse.

Using data for good

Using data for good, doesn’t preclude legally using it to develop and expand businesses, but certainly in the gambling industry it may hit profit in the short term due to the excesses of the past. Nobody should scream about this though, because a great deal of previous and present use of data has driven profit from unfairness and harm. A new era of transparency and improved legal data use, will produce a more sustainable, fairer and safer industry, thus benefitting all.

Nobody will be happy

Let’s assume we continue as is, in this Gambling Act review period, e.g. not to put a finer point on it, fairly frequent lying rhetoric. We may end up with:

- The fox i/c a ‘single customer view’, therefore an unlikely concentration on the very specific circumstances where customer data should (can) be shared and how

- Unpunished illegal data practices that lead to unfairness and harm

- Fines that mean nothing to large gambling corporations

- Cheating punters, being allowed to cheat with little consequence

If so, online in the UK, the gambling industry will eventually face the prospect of the banks, possibly utilising one central payment provider, being the conduit for money going into and out of the online UK gambling market. Some, I’ve spoken to, think this action should be taken now, one reason being, it takes the gambling companies out of the equation regarding harmful gambling spend across operators, e.g. an alternative to a ‘single customer view’. Of course, it does little if anything for improved fairness in the market without other changes being implemented at the same time.

The present reality

The UK has a gambling industry that regularly makes circa £13-14 billion gross, e.g. customer losses.

It still achieves this despite tiny over-rounds online for certain types of traditional sports bets. It can be argued, but I’m no expert, that one, if not more than one gambling company, uses parts of the UK sports betting market as a ‘loss leader’. This means, the UK online gambling industry has to make money using non-traditional sports betting and other gambling products, which research informs are more likely to cause harm (https://assets.ctfassets.net/j16ev64qyf6l/60qlzeoSZIJ2QxByMAGJqz/e3af209d552b08c16566a217ed422e68/Gambling-behaviour-in-Great-Britain-2016.pdf [Table 5:5] & https://natcen.ac.uk/media/1464625/gambling-behaviour-in-great-britain-2015.pdf [Table 4:5]). It also means that people who are skilled at traditional sports betting have to be removed from the UK online gambling market. This latter need, has led to illegal data sharing between some gambling companies, both Cracked Labs and J4P have proven this.

This is the reality, the UK’s online traditional sports betting market is broken (shush, don’t tell anyone). It is uneconomic for those companies with high cost bases, unless companies trade in ways that don’t reflect their marketing (thus unfairly) and/or move customers towards more dangerous gambling products, including non-traditional sports betting, like in-play.

The ‘hospital pass’ has now gone to the DCMS: Best of luck with telling the difference between the truth and lies, you’ll need it.